Ford Commercial Vehicles

Whether you're hauling crucial equipment, delivering fragile goods or transporting injured patients, there's a BUILT FORD TOUGH® vehicle that can get the job done. From vans and passenger wagons to pickups and cutaways, our commercial trucks and vans offer the versatility and ruggedness hard workers count on.

The Right Vehicle

Commercial Vehicle Center dealers are certified experts in finding the right vehicle for your particular application. Among the methods employed is a proprietary Ford software system called Commercial Vehicle Tools (CVT). It provides the GVWR, payload, cargo volume, upfit and other vital specifications the dealer uses to match a vehicle to your exact requirements. Commercial vehicles are also available on-site for you to inspect and test-drive.

Service, Maintenance and Parts

Your Commercial Vehicle Center dealer is with you every step of the way for the long haul, beyond the day you take vehicle delivery. Priority scheduling. Extended hours. Specialized training. Improved in-stock parts availability. Service discounts. New service part warranty. Extended service plans. Rentals and loaners available. And more. Enjoy all the features specifically geared to your business that relies on dependable commercial vehicles.

Financing Options

Finding the right vehicle isn't enough. Having the right financing plan is just as important to your commercial investment, whether you're an independent owner-operator or a fleet manager. Your Commercial Vehicle Center dealer has expertise in finding the best way to finance your investment, with terms that are right for you from the variety of Ford Credit retail and lease plans including the comprehensive Ford Fleet Care program.

Upfitting and Fleet Expertise

With expert knowledge of commercial vehicles and their applications, your Commercial Vehicle Center dealer is specially qualified to meet your unique commercial needs - to ensure the right upfit body or accessory for your application is built and installed to your precise specifications, to make sure you benefit from any financial incentives available, and to get your completed vehicle on the job as soon as possible and working hard for you.

2025 E-Series Stripped Chassis

With a variety of available wheelbase and GVWR options, the E-Series Stripped Chassis offers high capability and performance for delivery applications.

2024 F-Series Stripped Chassis

The 2024 F-59 Commercial Stripped Chassis provides a strong base for your business, with a heavy-duty steel frame that allows for easy upfitting.

2025 E-Series Cutaway

The 2025 Ford E-Series Cutaway is capable and work-ready, serving as a durable vehicle for businesses across the country.

2024 Transit® Chassis Cab and Cutaway

2024 Ford Transit® Chassis Cab and Cutaway models offer a choice of responsive gas engines and up-to-date technologies to help you move your business forward with confidence.

2024 Transit® Van

The 2024 Transit® van is your trusted business partner, designed with your productivity, comfort and bottom line in mind.

2024 Super Duty®

Super Duty® pickup trucks offer cutting-edge technology to make towing simpler - and colossal power to get you moving.

2024 Super Duty® Chassis Cab

The 2024 Super Duty® Chassis Cab unites serious engine power with an upfit-friendly design and available work-ready technologies.

2024 E-Transit™

The 2024 E-Transit™ van offers multiple vehicle lengths and roof heights, with available Pro Power Onboard to help you get the job done.

2025 F-650®F-750®

The 2025 lineup of Medium Duty trucks gives you powertrain and upfit options, along with the BUILT FORD TOUGH® capability you expect.

Transit Connect®

The Transit Connect® van is your efficient and spacious urban work vehicle, with a variety of available upfits for maximum versatility.

SECTION 179 TAX BENEFITS

Maximize Your Business Potential with Section 179 Deductions

Unlock greater financial flexibility for your business with the Section 179 deduction. A part of the IRS tax code, Section 179 allows businesses to deduct the full purchase price of qualifying equipment bought or financed during the tax year. This significant tax incentive is designed to encourage businesses to invest in themselves by purchasing the equipment they need to grow. Section 179 can be extremely profitable for your business, allowing you to invest in equipment, vehicles, and software while retaining more of your tax dollars.

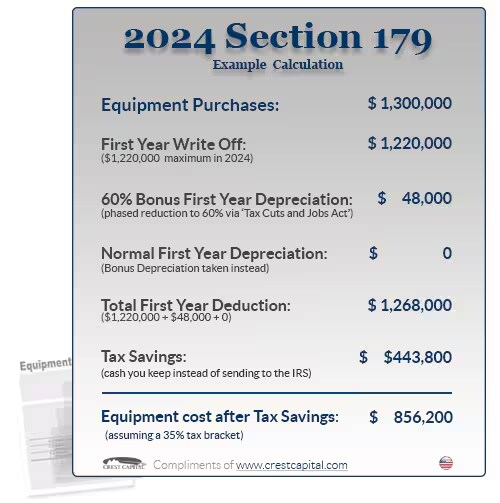

Section 179 at a Glance for 2024

2024 Deduction Limit = $1,220,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2024, the equipment must be financed or purchased and put into service between January 1, 2024 and the end of the day on December 31, 2024.

2024 Spending Cap on equipment purchases = $3,050,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive" (because larger businesses that spend more than $4,270,000 on equipment won't get the deduction.)

Bonus Depreciation: 60% for 2024

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment.

The above is an overall, "birds-eye" view of the Section 179 Deduction for 2024. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please read this entire website carefully. We will also make sure to update this page if the limits change.

Here is an updated example of Section 179 at work during the 2024 tax year.

What is the Section 179 Deduction

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn't, as you will see below.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Several years ago, Section 179 was often referred to as the "SUV Tax Loophole" or the "Hummer Deduction" because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUV's and Hummers). But that particular benefit of Section 179 has been severely reduced in recent years (see 'Vehicles & Section 179' for current limits on business vehicles.)

However, despite the SUV deduction lessened, Section 179 is more beneficial to small businesses than ever. Today, Section 179 is one of the few government incentives available to small businesses, and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses - and millions of small businesses are actually taking action and getting real benefits.

Here's How Section 179 works:

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

And that's exactly what Section 179 does - it allows your business to write off the entire purchase price of qualifying equipment for the current tax year.

This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2024 tax return (up to $1,220,000).

Limits of Section 179

Section 179 does come with limits - there are caps to the total amount written off ($1,220,000 for 2024 ), and limits to the total amount of the equipment purchased ($3,050,000 in 2024 ). The deduction begins to phase out on a dollar-for-dollar basis after this limit is reached by a given business (thus, the entire deduction goes away once $4,270,000 in purchases is reached), so this makes it a true small and medium-sized business deduction.

Who Qualifies for Section 179?

All businesses that purchase, finance, and/or lease new or used business equipment during tax year 2024 should qualify for the Section 179 Deduction (assuming they spend less than $4,270,000).

Most tangible goods used by American businesses, including "off-the-shelf" software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction.

For basic guidelines on what property is covered under the Section 179 tax code, please refer to list of Section 179 Qualifying Equipment. Also, to qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2024 and December 31, 2024.

For 2024, $1,220,000 of assets can be expensed; that amount phases out dollar for dollar when $3,050,000 of qualified assets are placed in service.

What's the difference between Section 179 and Bonus Depreciation?

Bonus depreciation is offered some years, and some years it isn't. Right now in 2024, it's being offered at 60%.

The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is "new to you"), while Bonus Depreciation has only covered new equipment only until the most recent tax law passed. In a switch from recent years, the bonus depreciation now includes used equipment.

Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $3,050,000) on new capital equipment. Also, businesses with a net loss are still qualified to deduct some of the cost of new equipment and carry-forward the loss.

When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation - unless the business had no taxable profit, because the unprofitable business is allowed to carry the loss forward to future years.

Section 179's "More Than 50 Percent Business-Use" Requirement

The equipment, vehicle(s), and/or software must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction. Simply multiply the cost of the equipment, vehicle(s), and/or software by the percentage of business-use to arrive at the monetary amount eligible for Section 179.

Please see https://www.section179.org/section_179_deduction/ for more information.

How can we help?

* Indicates a required field

-

Blackwell Ford

41001 Plymouth Road

Plymouth, MI 48170

- Sales: (734) 453-1100